-

The Harsh Realities Of Business Influencers

I’ve been fortunate enough, at 26, to have bought and sold a business, and then taken another business from zero to $10M in cash collected in under three years. I got here through a shit ton of hard work, networking, learning, and time. What people on Instagram and social media don’t tell you is how…

-

What it takes to build a $10M business in under 3 years.

When we first started this blog, I was at my absolute infancy in business and life. Just learning the stock market and learning how money grows in this capitalistic country. Started this blog to document my path on the journey of financial freedom. Haven’t posted in over a year because I’ve been knee-deep into business.…

-

Networking on the Internet Will Change Your Life

Since the start of this blog back in 2018, I have been infatuated with trying to monetize online through various ideas, like dropshipping phone chargers or starting a paid stock group chat. I was in an endless battle of trying to make money online from anywhere on Earth, experimenting with tons of different things until…

-

Life As A Entrepreneur

Four years ago, when this journey began, I was thrown into a tank with sharks. Four years later, I am still in the same tank and becoming a bigger fish each day. The lessons I have learned during this time have been incredible. Looking back at my first blog post to today, a lot has…

-

Brain dump- Life is good

Exited my first business 2 months ago. No longer a garbage business owner anymore. I got an ROI of 233% and was able to learn what it was like to run my first business. Feels like I got my MBA without the school part two years out of college and I was able to profit…

-

Life Update: Wrapping Up Q3

Life Update: Wrapping Up Q3 2023 I’m going to start blogging again. 2023 has been a year of immense self-improvement for me. I haven’t posted since 2021, but since then, I’ve made significant strides toward achieving financial freedom! In my current state, I enjoy unparalleled freedom. Despite running two businesses, I can travel and operate…

-

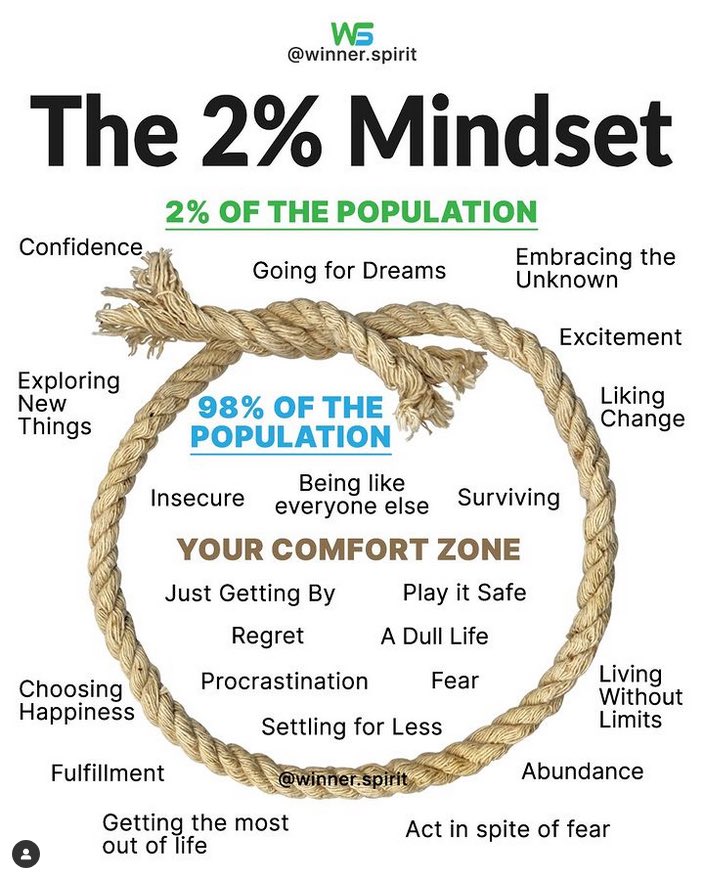

Riding the Rollercoaster: Embracing the 2% Mindset

When it comes to personal growth and achievement, there are two distinct groups that people tend to fall into. The majority, approximately 98% of people, prefer the comfort and safety of the known. They stay within their comfort zones, hesitant to face the unknown, settle for less, and often succumb to procrastination. They’re content to…

-

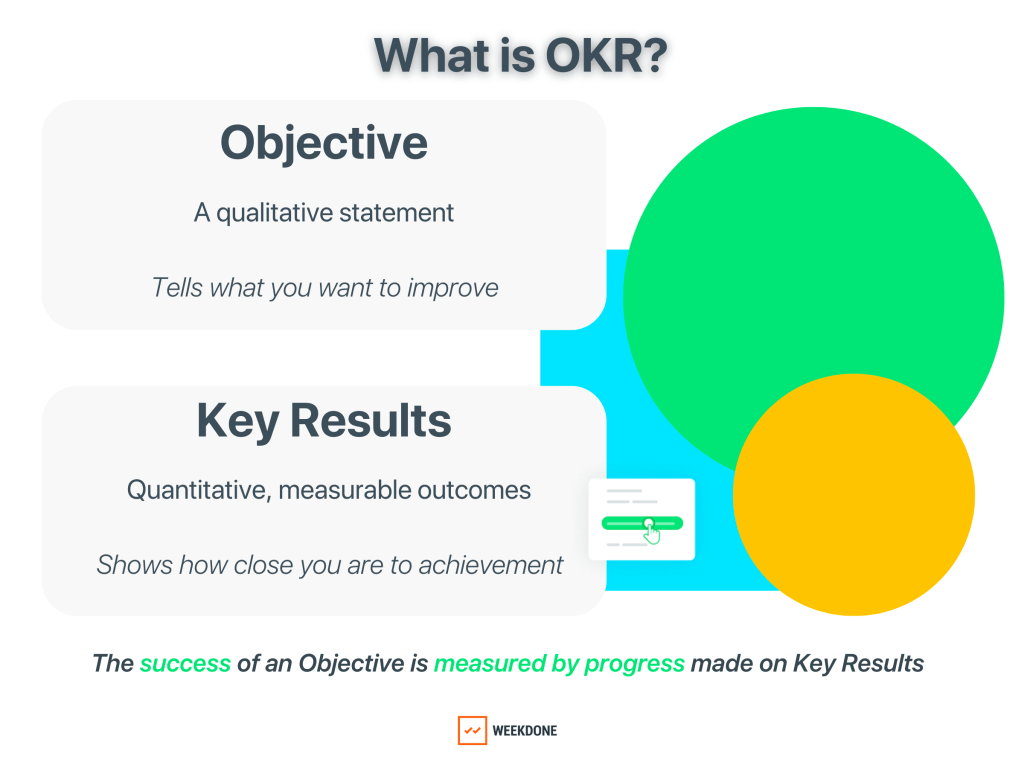

The Power of OKRs: Bridging the Gap Between Strategy and Execution

Effective goal-setting is a crucial skill that many companies, and individuals alike, struggle to master. Yet, some of the world’s leading tech giants like Google, Amazon, and Microsoft seem to have cracked the code. The secret? A goal-setting framework known as Objectives and Key Results (OKRs), originally introduced in 1983 by Andy Grove, the former…

-

First Steps in Stock Market: A Guide for the Young Investor

Have you been saving money from your weekend jobs and are now thinking about investing? That’s a great idea! The world of investing can seem complex, but understanding some basic concepts can make it much less intimidating. Today, we’re going to cover some stock market basics that will help you make informed decisions about where…

-

Credit Card Savvy: Building a Healthy Credit History Early On

Understanding credit cards and the associated responsibilities may not be part of the traditional high school or college curriculum, but it’s an essential life skill that young adults need to master. Establishing a healthy credit history is a significant step towards financial freedom and independence, as it’s often a critical factor when you need to…