Welcome to our blog, where we explore the art of budgeting and its significance in achieving financial success. In this post, we will delve into the power of budgeting, how it empowers individuals to take control of their finances, and why it serves as a foundation for financial well-being. Let’s dive in!

The Power of Budgeting

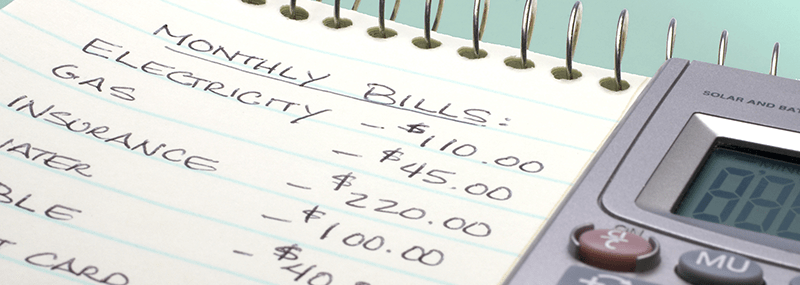

Budgeting is a powerful financial tool that allows individuals to gain a clear understanding of their income, expenses, and overall financial picture. It is the process of creating a plan for how money will be allocated, enabling individuals to make informed decisions about saving, spending, and investing.

By creating a budget, young adults can take control of their finances and prioritize their financial goals. It provides a framework for managing income and expenses, helping individuals avoid overspending and living beyond their means. Budgeting empowers individuals to make intentional choices about how they allocate their money, fostering financial discipline and responsible money management.

Achieving Financial Goals

One of the greatest benefits of budgeting is its role in helping individuals achieve their financial goals. By creating a budget, young adults can define their financial aspirations, whether it’s building an emergency fund, paying off debt, saving for a down payment, or investing for retirement.

A budget serves as a roadmap to these goals. It allows individuals to allocate resources toward their priorities and make incremental progress over time. By tracking expenses and identifying areas where adjustments can be made, young adults can find opportunities to save and invest more effectively.

Financial Awareness and Decision-Making

Budgeting cultivates financial awareness, enabling individuals to make informed decisions about their money. By tracking income and expenses, individuals gain insight into their spending habits and patterns. This awareness helps them identify areas where adjustments can be made to align with their financial goals.

Budgeting also promotes mindful spending. With a budget in place, individuals are less likely to make impulsive purchases. Instead, they can evaluate their financial resources and consciously allocate them towards what truly matters to them. This not only reduces unnecessary spending but also helps individuals align their financial choices with their values and priorities.

Moreover, budgeting provides a solid foundation for making important financial decisions. Whether it’s planning for major life events, handling unexpected expenses, or preparing for the future, having a budget in place ensures individuals can make informed choices based on their financial realities.

Conclusion

Budgeting is a transformative skill that empowers individuals to take control of their finances and make informed decisions about their money. By creating a budget, young adults can pave the way for financial success, achieve their goals, and build a strong foundation for a secure financial future.

Leave a comment