As a child, many of us eagerly awaited our turn to play the banker in the game of Monopoly, distributing money to fellow players, collecting rent, and hopefully, driving others to bankruptcy while building a real estate empire. As grown-ups, we realize that Monopoly was not just a game, but a lesson in finance and strategic decision-making.

Monopoly’s roots stretch back to 1903, created as an educational tool to illustrate the negative aspects of concentrating land in private monopolies. Over a century later, it continues to teach valuable lessons in economics and finance, from the basics of buy low/sell high and the risks of over-leveraging, to the negotiation tactics required for successful trades.

Let’s delve a bit deeper into Monopoly. As players maneuver around the board, they are given opportunities to buy properties. The aim is to acquire as many as possible, create monopolies, and build houses and hotels, thereby increasing the rent that other players must pay when they land on your property. This mimics the concept of real estate investing, where strategic acquisitions can lead to regular income.

Monopoly teaches us the power of passive income and cash flow. Once you own a property and someone lands on it, you collect rent, demonstrating how assets can generate cash flow over time. You also learn about debt, as taking a mortgage on a property can lead to financial strain if you’re not careful.

Monopoly also subtly teaches us about market dynamics – supply and demand, bargaining power, and the perils of a monopoly. When you hold all the properties of a color, you have a monopoly and can charge higher rent, much like a company dominating a market.

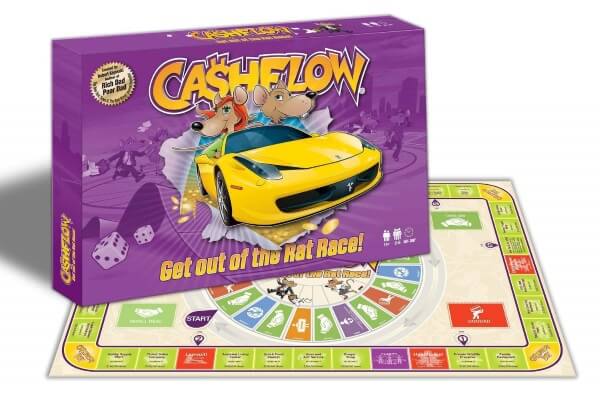

However, if Monopoly laid the foundation for financial education, ‘Cash Flow’, a board game developed by financial educator and businessman Robert Kiyosaki, built an entire mansion on it. Introduced in 1996, Cash Flow takes the financial lessons offered by Monopoly and catapults them into a realm more reflective of the real financial world.

Players in Cash Flow start in the ‘Rat Race’, with a profession and a corresponding salary, and aim to achieve financial freedom. The game is infused with real-world financial situations – players juggle income with expenses, handle surprise bills, buy and sell stocks, invest in real estate, and strategize to generate passive income.

The goal is not just to accumulate wealth, but to balance your income and expenses efficiently, escape the Rat Race, and enter the Fast Track, where bigger investment opportunities await. Cash Flow imparts lessons on financial literacy in a way that textbooks can’t, making players grapple with financial decisions and see the immediate consequences of their actions.

Both Monopoly and Cash Flow foster strategic thinking and financial acumen in a fun and engaging way. They not only teach players the importance of cash flow, diversification, and investment, but also that financial success is a result of informed decision-making and forward planning.

In conclusion, whether it’s the vintage charm of Monopoly with its real estate investment lessons or the more intricate mechanics of Cash Flow, these board games are excellent tools to instill financial literacy, providing a stepping stone for understanding real-world economic principles. So the next time you’re eyeing that hotel on Mayfair or weighing an investment in a Cash Flow condominium, remember – it’s not just a game, it’s a lesson in finance!

Leave a comment