Microsoft, a globally renowned technology company, continues to dominate the industry with its innovative products, strong brand presence, and remarkable financial performance. In this blog post, we will delve into Microsoft’s Q3 FY23 Income Statement, highlighting its revenue streams, gross margin, operating expenses, and net profit. Additionally, we will explore Microsoft’s brand strength, the integration of OpenAI and Chat GPT into its business model, and discuss the future prospects for the company and investors.

Financial Highlights

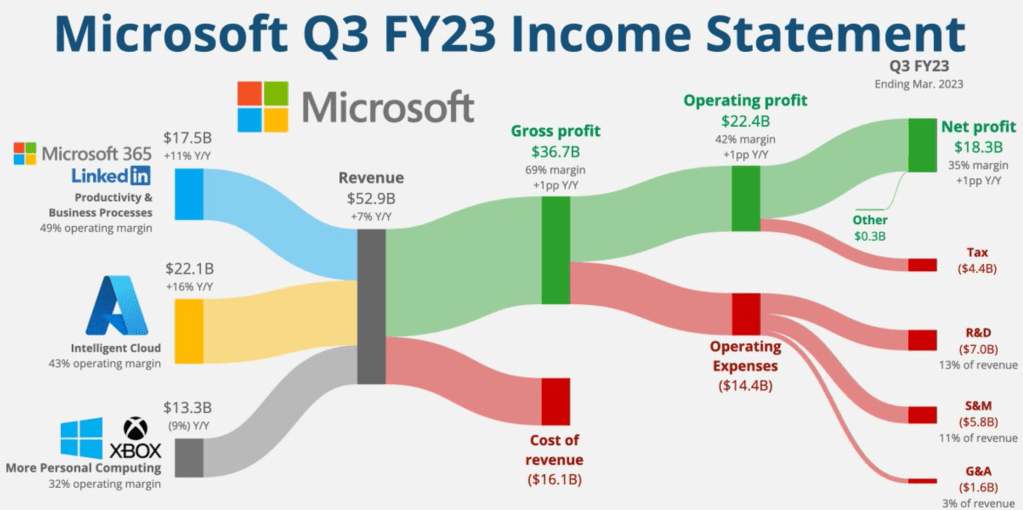

In Q3 FY23, Microsoft achieved total revenue of $52.9 billion, reflecting an impressive 7% year-on-year growth. Let’s take a closer look at the revenue breakdown:

- Productivity & Business Processes: This segment, including Microsoft 365 and LinkedIn, generated $17.5 billion in revenue, marking an 11% year-on-year growth. With a robust operating margin of 49%, this division showcases Microsoft’s dominance in the productivity software and professional networking spaces.

- Intelligent Cloud: Azure, Microsoft’s flagship cloud computing platform, contributed $22.1 billion in revenue, demonstrating a significant 16% year-on-year growth. The Intelligent Cloud segment maintains a strong operating margin of 43% and continues to be a key driver of Microsoft’s success.

- Personal Computing: While the Personal Computing segment faced a slight decline, with revenue of $13.3 billion and a 9% year-on-year decrease, it still maintains a healthy operating margin of 32%. This division encompasses Windows and Xbox, showcasing Microsoft’s presence in consumer-focused technology.

Gross Margin and Profitability

Microsoft’s gross profit stood at $36.7 billion, with an impressive gross margin of 69% and a positive year-on-year growth of 1 percentage point. The company’s ability to generate such substantial profits while maintaining a high gross margin highlights its efficient cost management and strong product performance.

Operating expenses amounted to $14.4 billion, comprising research and development (R&D) expenses of $7.08 billion (13% of revenue), sales and marketing (S&M) expenses of $5.8 billion (11% of revenue), and general and administrative (G&A) expenses of $1.6 billion (3% of revenue).

Operating Profit and Net Profit

Microsoft achieved an operating profit of $22.4 billion, reflecting a solid operating margin of 42% and a positive year-on-year growth of 1 percentage point. After accounting for taxes, the company achieved a net profit of $18.3 billion, with a remarkable net profit margin of 35% and a positive year-on-year growth of 1 percentage point.

Microsoft’s Brand Strength and Innovation

Beyond its financial success, Microsoft has built an incredible brand that is synonymous with reliability, innovation, and technological advancement. With iconic products like Windows, Office Suite, and Xbox, the company has established itself as a market leader across various sectors. Furthermore, Microsoft’s strategic acquisition of LinkedIn has expanded its reach in the professional networking space, allowing for synergies with its productivity software offerings.

Integration of OpenAI and Chat GPT

Microsoft’s partnership with OpenAI and integration of Chat GPT, an advanced language model, into its business model demonstrate the company’s commitment to leveraging cutting-edge technologies. This integration enables enhanced communication, automation, and decision-making capabilities across Microsoft’s suite of products and services, opening up new possibilities for productivity and personalization.

Future Outlook

Looking ahead, Microsoft is well-positioned for continued success and growth. With its diverse revenue streams, strong brand loyalty, and focus on innovation, the company is poised to capitalize on emerging technologies such as cloud computing, artificial intelligence, and the Internet of Things. Investors can expect Microsoft to remain a solid choice, offering stability and potential for long-term returns.

In conclusion, Microsoft’s Q3 FY23 Income Statement showcases the company’s financial prowess, with robust revenue growth, impressive gross margins, and strong profitability. Combined with its brand strength, integration of advanced technologies, and strategic vision, Microsoft stands as a force to be reckoned with in the tech industry, promising an exciting future for both the company and its investors.

Leave a comment