Apple Inc., the world-renowned tech giant, has a legendary reputation for its innovative products and services. In this blog post, we will explore Apple’s Q2 FY23 income statement, unpacking the financial health of the company. We’ll also delve into their brand value, recent product launches, and what the future may hold for investors.

Q2 FY23 Earnings Review

Revenue Analysis

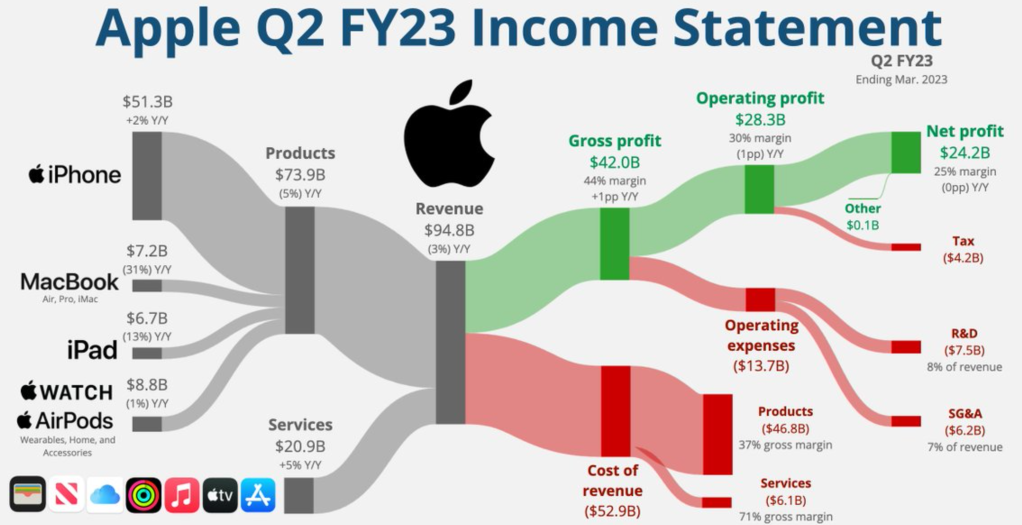

Apple posted a total revenue of $94.8 billion, marking a 3% year-over-year decline. Revenue from products, which accounted for a large chunk of the total revenue ($73.9 billion), saw a 5% decline Y/Y. This revenue breakdown revealed mixed results for Apple’s product lineup.

iPhone, the flagship product, continued to show robust performance with a 2% increase Y/Y, garnering $51.3 billion. However, not all products followed suit. MacBook’s revenue took a notable dip at $7.2 billion, marking a 31% drop Y/Y. The iPad wasn’t immune either, with its revenue shrinking by 13% Y/Y to $6.7 billion. The combined revenue from Apple Watch and AirPods remained relatively stable, showing a slight 1% dip Y/Y to $8.8 billion.

On a brighter note, services, the other key part of Apple’s revenue structure, saw a 5% Y/Y increase, netting $20.9 billion. This growth reflects the company’s successful push towards diversifying its revenue streams beyond product sales.

Cost of Revenue

Apple’s cost of revenue stood at $52.9 billion. Among this, products and services had costs of $46.8 billion and $6.1 billion respectively, yielding gross margins of 37% and 71% respectively. These figures indicate the higher profitability of Apple’s services sector compared to its products.

Gross Profit and Operating Expenses

Apple managed a gross profit of $42 billion, translating to a 44% margin and marking a 1pp increase Y/Y. The total operating expenses stood at $13.7 billion. R&D expenses were $7.5 billion (8% of revenue), while SG&A expenses accounted for $6.2 billion (7% of revenue). This highlights Apple’s continuous commitment to investing in its future.

Net Profit

After accounting for $4.2 billion in taxes, Apple’s net profit was $24.2 billion, maintaining a 25% margin Y/Y.

Brand Value and Innovation

Apple’s brand value is backed by the unrivaled design and quality of its products, underpinned by a strong consumer trust that it has earned over the years. Apple’s consistent innovation is another driving force behind its brand value. The new Apple Vision Pro, for example, showcases Apple’s commitment to introducing cutting-edge technology to its consumers.

Outlook for Investors

Despite the mixed bag of financial results, Apple continues to be an attractive proposition for investors. The company’s commitment to R&D suggests a focus on innovation, which can lead to potential new revenue streams. Additionally, the consistent growth in the services sector demonstrates Apple’s resilience and adaptability in diversifying its business.

While Apple faces challenges, including fluctuating product revenue, it continues to be a dominant player in the tech industry. Its ability to innovate, combined with a robust services sector, indicate a promising future for investors.

Conclusion

Apple’s Q2 FY23 financial performance paints a picture of a company that, despite facing headwinds in some product categories, continues to thrive through innovation and diversification. The success of the iPhone and the growing services sector are testament to Apple’s enduring appeal and strategic foresight. As the company continues to invest in its future, the prospects for Apple and its investors remain promising.

Leave a comment