-

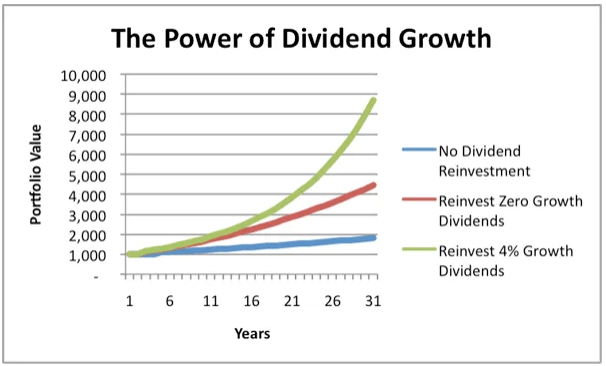

Dividend Reinvestment

Dividend Reinvestment, what exactly does that mean? First, you need to understand what a dividend is. If you need a refresher, please check out Tunaman222’s post called “What is a Dividend?”. So now you understand what a dividend is. The idea of dividend reinvestment will take your portfolio to the next level, and it is…

-

Investing in the S&P Compared to a Bank CD

Investing in stocks is very important for long term growth, but be aware of volatility and risk. A bank CD is a safe way to save money without any risk. With a bank CD, the account owner gains an annual interest of only around 2-5%. To me, that is not enough, and I think investing…

-

How to Invest Like Warren Buffet

As we all know Warren Buffet is the most successful investor in the world. Modeling our investing strategies after him are crucial. Here is a list of questions inspired by Buffet we ask ourselves before purchasing a stock: How unique are the products sold by the company? How much debt does the company have? How…

-

Saving 101.1

Continuing our saving posts, I’d like to explain what to do when you’ve acquired your paycheck. So I will walk you through a 5 step strategy that we use. This will be structured for a monthly paycheck and how we would divide it up, but this strategy can be applied to any paycheck you receive.…

-

Saving 101

Taking a step back from what our investment strategies and goals are, I would like to take the time to create content on how to save money for your investments. This will be the first of many posts talking about strategies and theories we use and follow that help us build our investment portfolios. Now…

-

Building Your Credit as a College Student

Not establishing credit as a college student will hurt you in the long run. I applied for my first credit card the summer going into my freshman year of college. I received a $300 limit to build my credit, within one year, my credit score went from 650 to 719. As a commuter, the way…

-

What is a Recession?

Economic recessions are a period of temporary economic decline when global trade and industrial activity are reduced. Recessions are recognized when there is a fall in GDP in two successive quarters. There have been 47 recessions within the U.S since the Articles of Confederation, and only 13 since the great depression. Recession is a normal…

-

Our Ratios

Something new to us is the ratios you see in the sidebar. These ratios are used to get a feeling for a company’s liquidity, activity, and profitability. The ratios are broken into three categories called Solvency (liquidity), Efficiency (activity), and Profitability. So what do these mean?

-

Diversification is Key

Diversification is important for successful investing. Like Warren Buffet says, “don’t place all your eggs into one basket.” Diversification is a technique used to reduce risk in your investment portfolio. The goal is to increase your odds of success. Essentially you want to diversify because specific markets could be volatile and unpredictable. Let’s say you…

-

Financial Freedom

When we bought our first stock, we were lost. No direction. No mentors. No accounts. Little money. We had no idea what we were getting ourselves into. Even though we started at level zero, we knew the stock market would become an essential part of our financial life, which lead us to derive our end…