Financial Literacy

-

Budgeting: The Key to Financial Success

Welcome to our blog, where we explore the art of budgeting and its significance in achieving financial success. In this post, we will delve into the power of budgeting, how it empowers individuals to take control of their finances, and why it serves as a foundation for financial well-being. Let’s dive in! The Power of…

-

Mastering Debt Management: A Crucial Step Towards Financial Freedom

In today’s post, we will delve into the critical concept of debt management. As young adults embark on their professional journeys, understanding how to handle debt responsibly is vital for maintaining financial well-being. Join us as we explore key strategies for managing debt effectively and building a solid foundation for a secure financial future. Understanding…

-

What is the 10-Year Treasury Yield?

The 10-Year Treasury Yield gets more attention and press than other security provided by the US Government. A fluctuating 10-year yield can have significant implications across the financial landscape. For example, investors pay keen attention to the movements in the 10-Year Treasury Notes because they serve as a benchmark for other borrowing rates. T-Notes are…

-

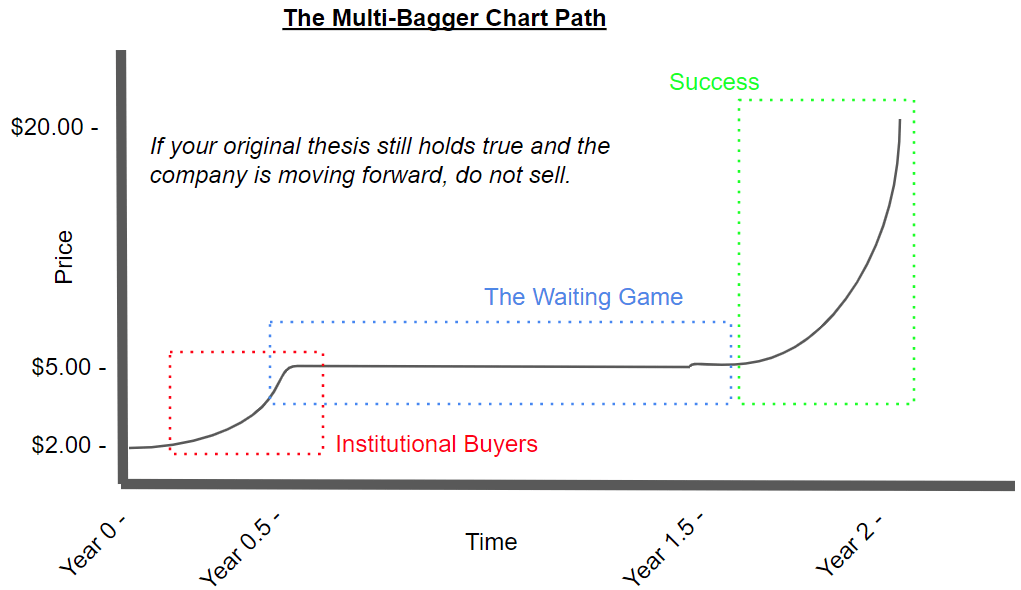

How to Trade a Potential Multi-Bagger Company

The term “Multi-Bagger” was coined by Peter Lynch in his book ‘One up on Wall Street’ which refers to stocks that return many times over the original investment, more than 100%. Multi-bagger stocks are undervalued and have strong financial fundamentals, thus presenting a great investment opportunity. Multi-bagger stocks also have a scalable business model and…

-

What is a Shelf Registration?

A shelf registration or shelf offering is a way for companies to raise additional capital. Companies will utilize this strategy when they know they need capital within the next 3 years. They will register an F-3 Form with the SEC. This lets them know that “we are putting X number of shares on the shelf”.…

-

How to Properly Research a Biotech Company

I recently made a post relating to what makes a Biotech Company worth Investing in and I wanted to make a follow-up post on how I conduct my research into a Biotech. To get yourself up to speed I would recommend checking out the first post here – What Biotech Company is Worth Investing In?…

-

3 Ways To Invest In Your Self

The best investment in your life is you. Many feel that their best investment is their real estate properties or their stock portfolio; both are essential in achieving financial freedom! But the without truly investing in yourself, real estate and a stock portfolio can be held back due to poor personal knowledge. When investing in…

-

$MSOS The ONLY U.S Cannabis ETF

Marijuana stocks are very popular right now. With the recent blue wave in the U.S., the cannabis industry should grow within the next four years. That’s understandable considering the growing number of countries and states that have legalized Marijuana in some form. Some Cannabis CEOS predict the industry to be worth up to $150 billion within the…

-

Buying $SLV to Hedge Against Inflation

The U.S dollar is in trouble. The U.S federal debt is over 25.5 trillion, and the current actual federal budget deficit is $3.6 trillion. If you are holding cash, it is essentially trash right now, inflation is eating your hard-earned money, and the more government is printing, the worse it will get. Federal debt is…

-

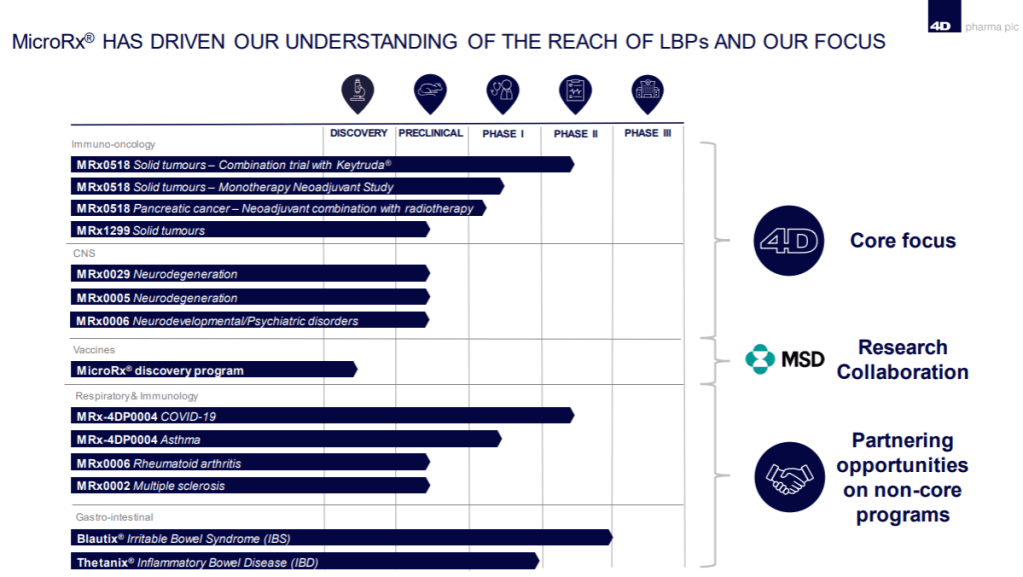

$LBPS The Next Big Biotech Drug Approval

$LBPS was originally $LOAC which was a SPAC that merged on March 17th, 2021 it merged with 4D Pharma: Leaders in Live Biotherapeutic Products (LBPs) to Revolutionize Treatments for Numerous Medical Conditions. Now the trick with this SPAC is not play the merger and get out early. This SPAC is all about the PRODUCT HITTING THE MARKET and gaining traction in…