-

What is an IRA?

An IRA is an individual retirement account. It allows you to save money for retirement in a taxed advantage way. It is an account set up by a specific financial institution that allows an individual to set aside funds for retirement savings. There are several types of IRAs as of 2020: they are traditional IRAs…

-

The Top Investing Books by @elite.investor

The Top Investing Books One thing that I get asked WAY too often is, what are the best books on investing? What are the must-reads that everyone has to read in order to be successful at this game? What if I’m a beginner? What should I be reading to get myself started? -The Intelligent Investor…

-

Frugal Living 101

I am often called cheap, by my parents by my friends, and even of course by my girlfriend. I agree with all of them, and that is because I am cheap for a reason, Financial Freedom. When I am 40 years old, my cheap frugal ways from my 20s will pay off. Frugal living is the…

-

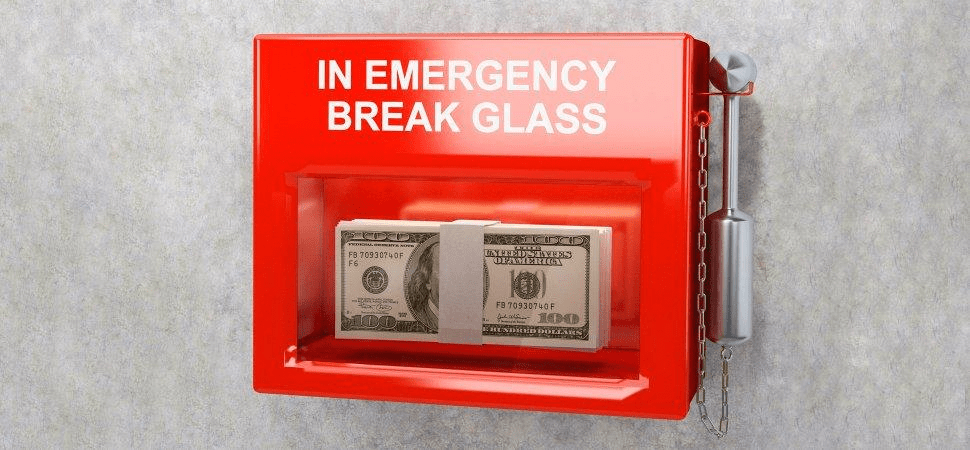

Emergency Funds 101: Why You Need One

Before you start saving or investing – make sure that you have an emergency fund, first! What is an emergency fund? Let’s face it – life is unpredictable (and frankly, kind of unfair!). It throws us challenges and unexpected costs. Expenses such as your car breaking down or losing your job. In order to safeguard…

-

Book Summary: Manny Khoshbin’s Contrarian Playbook (Part 2)

Make Your Money On The Buy! This is part 2 of the Contrarian Playbook summary. If you haven’t read part 1 yet click here. If you have read part one and you are here for part 2, I am excited to say you have come to the right place. In part 2 we will be…

-

Book Summary: Manny Khoshbin’s Contrarian Playbook (Part 1)

Along with growing our wealth from the stock market, Bodhi and I plan to obtain real estate licenses and purchase income properties. We plan to open a joint corporation and build a real estate career from it. This will allow us to take the next step in obtaining financial freedom. To begin this career we…

-

How to Build a LONG TERM Investment Portfolio

In this post, I will be going over my personal attack strategy when it comes to buying stocks for a long term position. We will look at what a good entry position is, what stocks should you buy, and how to decide how many to buy. It is also important to note that this is…

-

The First Steps Of Moving Averages

A moving average is an average price for a trading instrument over a set time frame. they are technical tools used on charts for trend identification. They can be used as standalone lines for trend trading, or in conjunction with other technical indicators like RSI and Bollinger bands. Moving averages are one of the building blocks…

-

What is an ETF?

An ETF is short for exchange-traded funds. It is an investment fund traded on stock exchanges, much like stocks. ETFs are used to group sectors of industry and create less risk for investors. Let’s look at an example. The best example is to look at the ETF for the S&P 500. This is known as…

-

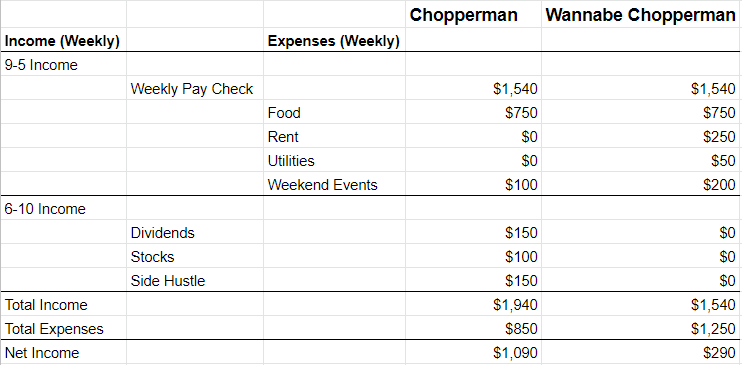

My 9-5 and 6-10 Jobs

You’re probably asking yourself what are my 9-5 and 6-10 jobs? This is another important factor in becoming financially free. The concept is to use the degree I have earned through college to get a solid job in a growing company, working “9am-5pm”. This ideally will be your main source of income. The “6-10”…