-

$GHIV The BIGGEST SPAC Deal Ever

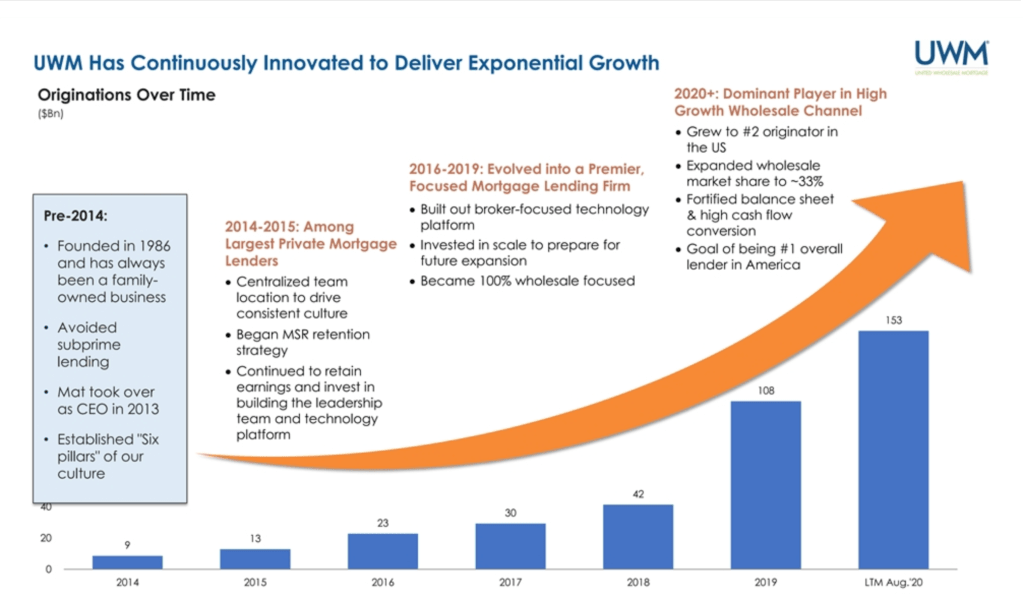

$GHIV is merging with United Wholesale Mortgage with a transaction value of $16.1 billion. The Merger date is January 22nd, 2021. This transaction value will make UWM the largest SPAC transaction ever. UWM is already the #2 mortgage originator and the #1 wholesale originator in the U.S., making this SPAC poised to bring significant returns. No, this SPAC is not some sexy, young EV play…

-

$NGA The Next EV SPAC to blow up

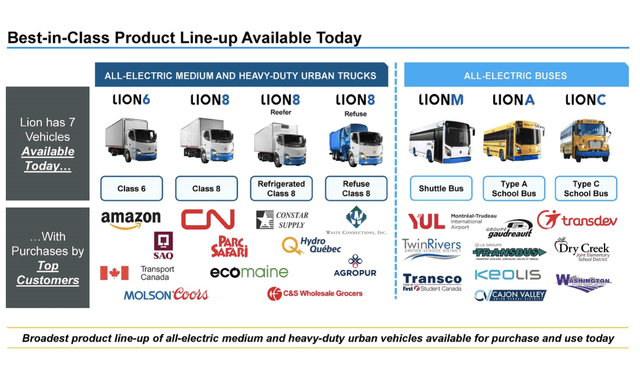

Lions vehicles are purpose-built for electricity and entirely designed and assembled in house. Lion Electric is a very diverse company. They produce EV busses and also produce electric trucks and batteries, that reduce or eliminate exhaust emissions to combat global warming. The electric vehicle industry is growing rapidly and I think Lion Electric will continue…

-

What is value investing, and what makes it attractive?

Guest post by @elite.investor host of Market Champions Podcast A lot of us value guys find it interesting how not everyone is into value. Value investing is as old as the hills. It’s about buying something for less than what it’s worth. As Ben Graham has pointed out, one has to buy stocks like he…

-

SPAC Cannabis Play $SBVCF

California is the gold coast for cannabis it is the largest and most influential cannabis market in the world, and The Parent Company $SBVCF has the most revenue, brand portfolio, and Strongest balance sheet compared to rival companies, and its only in the early phase of its SPAC life, this SPAC is bound to jump…

-

200 Day Moving Average: How to use it and How it Works

The 200-day moving average is an excellent indicator of the chart when to profit on a company you went long-on. Staying on the right side of a long term trend can be as easy as the stock staying above the 200-day moving average. A loss of the 200-day is your first warning of a possible downtrend…

-

Basics of The Relative Strength Index (RSI)

The relative strength index AKA “RSI” is a momentum indicator that shows when a stock or ETF is either overbought or oversold. It was developed by J. Welles Wilder back in the 70s. The RSI is displayed at the bottom of your chart and is displayed as an oscillator. The RSI has readings from 0 to 100; when an asset is…

-

What Is A 3 Fund Portfolio?

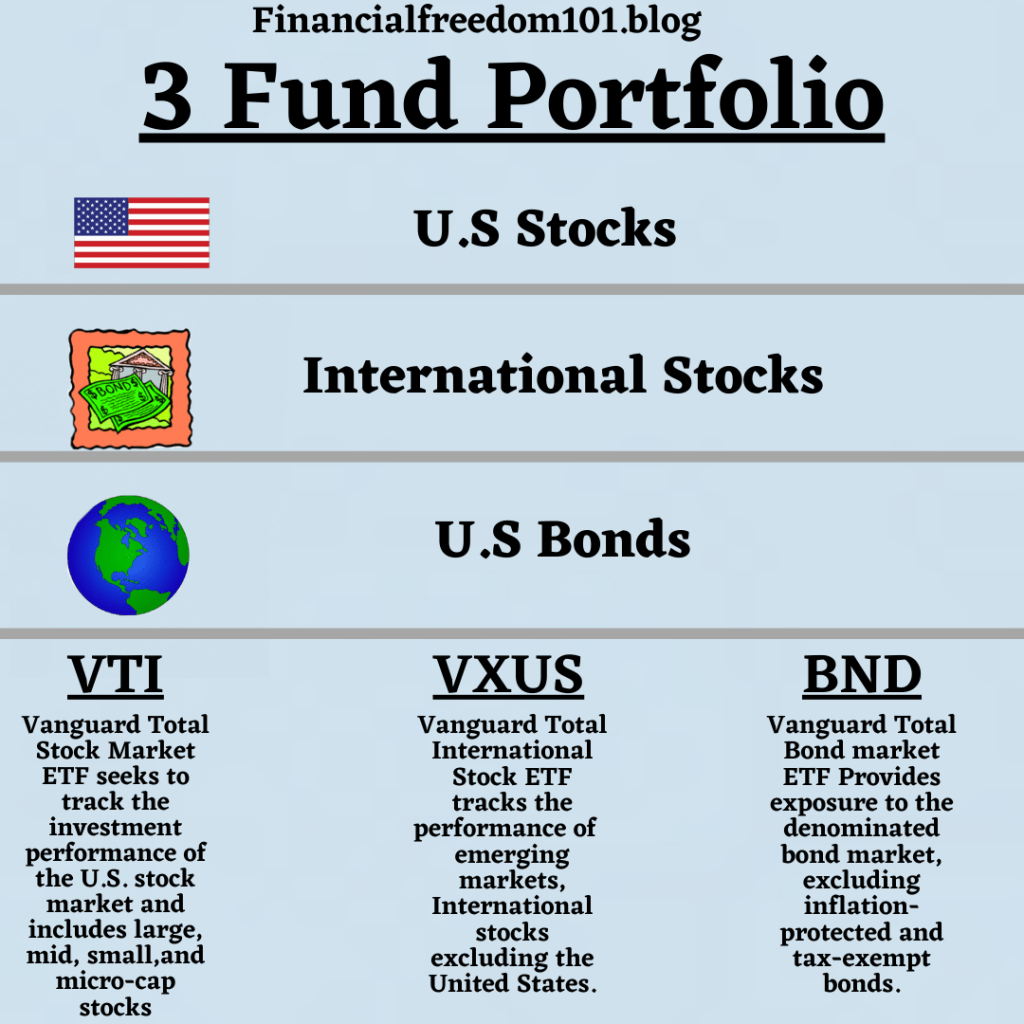

A three-fund portfolio is a great beginner low-risk portfolio that is a low-cost way to invest in the three major asset classes: 70% U.S. stocks, 20% international stocks, and 10% U.S. bonds. This kind of portfolio is a simple yet cost-effective way to invest in the market. This example is an aggressively weighted portfolio as…

-

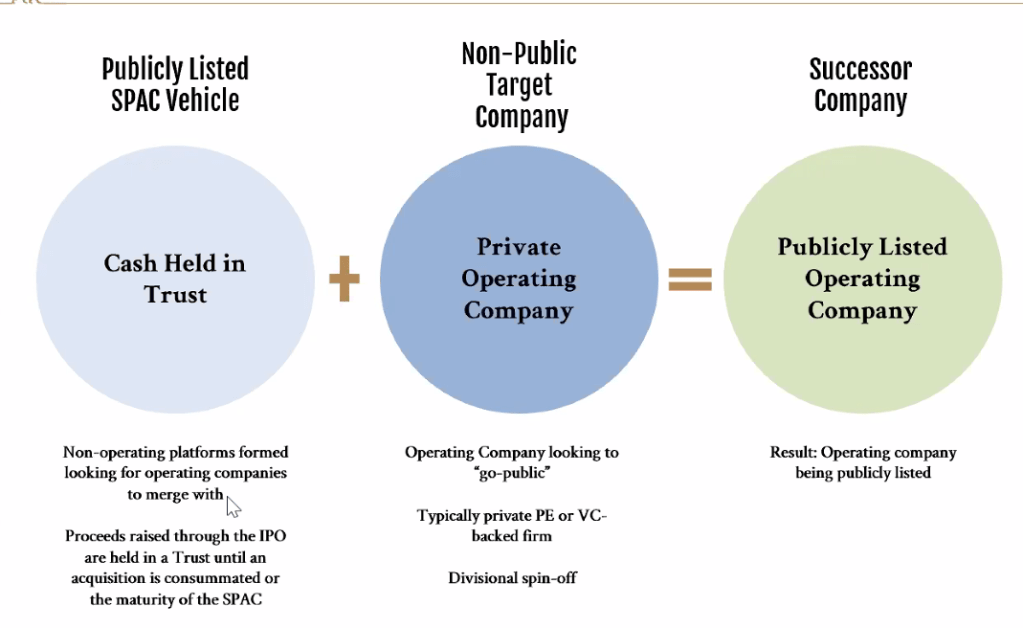

What is a SPAC?

A SPAC is a Special Purpose Acquisition Company. The idea of a SPAC started way back in 2003 and since then over 525 SPACs have gone public. This is a form of an IPO. If you don’t know what an IPO is check Bodhi’s post here. Recently SPACs have been blowing up the investment world.…

-

Compound Interest “The Eighth Wonder Of The World”

Compound Interest is the eighth wonder in the world in the eyes of a stock trader/investor. Compound interest makes a sum of money grow at a faster rate than simple interest because in addition to earning returns on the money you invest, you also earn returns on those returns at the end of every compounding…

-

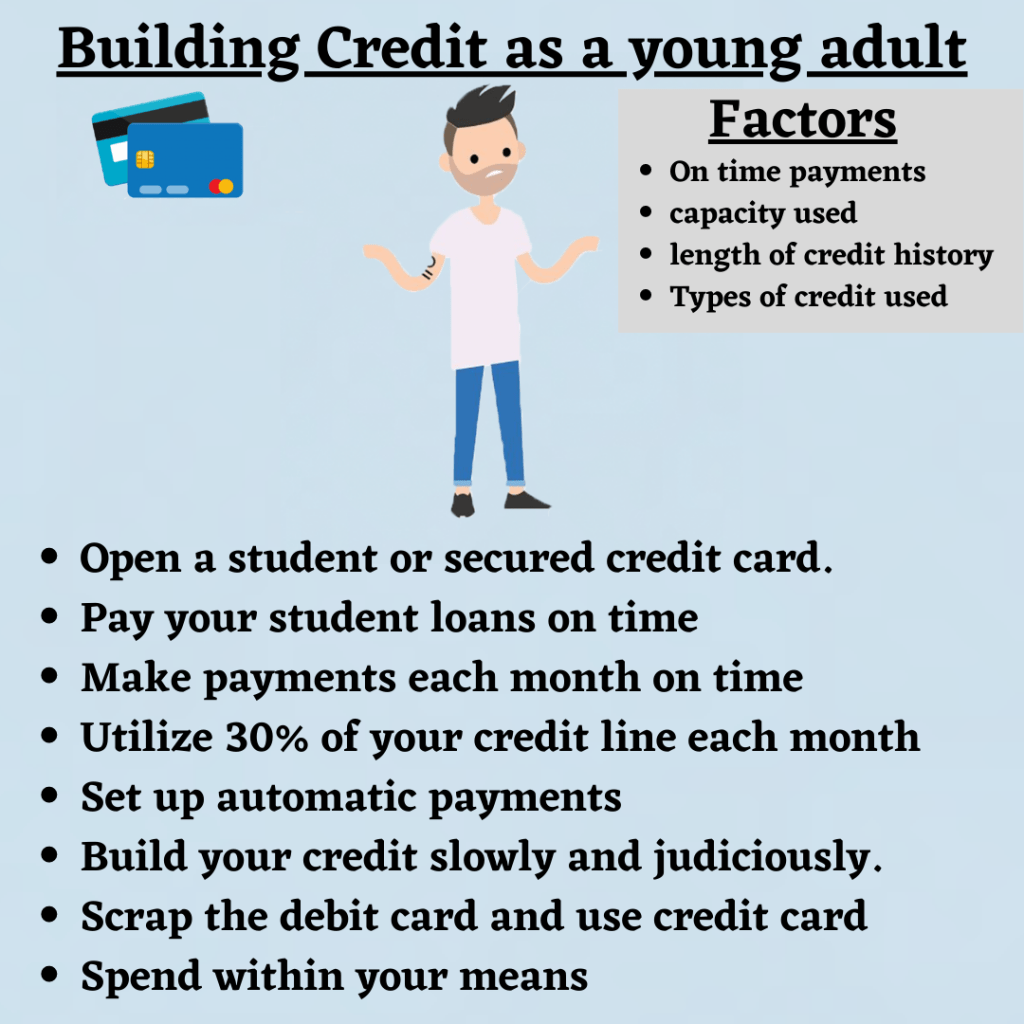

Why You Should Build Credit as a Young Adult

When I was a senior in high school I had a teacher who drilled in my head that credit cards are IMPORTANT, he explained that achieving a good credit score is necessary to achieve strong financial health. Once I was able to apply for one I got off to the races and started building my…