-

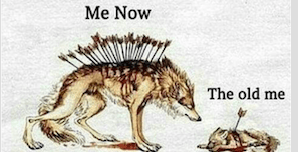

Surviving Adversity

Recently my mentor shared an article with me, it emphasizes the mindset of accepting and preparing for adversity. The article talks about a quote from Warren Buffet that needed some light shined on it. Back in Berkshire’s 2001 financial report, Buffet said: “Predicting rain doesn’t count, building an arc does.” This is considered The Noahs…

-

Alternative Way’s to Invest In Real Estate

Stocks and real estate are known to be two of the largest contributors to building wealth. People often say that it is difficult to invest in real estate due to the high costs and the amount of capital needed to purchase a home, apartment, or property. Chopperman and I plan to own our own real…

-

Microsoft Analysis

Microsoft… where to begin. Tunaman and I first bought Microsoft after the correction in December 2018. The stock was then priced at $100. We thought we were nuts for buying a couple of shares for this price. Now looking back, I wish I put all of my money into MSFT. The company is currently trading…

-

How We can Fill the Financial Void in Young Adults

Throughout the great years of high school, no one ever sat me down to discuss what possibilities I could have financially in the future. All my teachers, guidance counselors, and coaches only asked me how my grades are, what do I want to study, or what was I planning to do after I graduated high…

-

Seven Things Successful People Say no to Everyday

They say no to opportunities and things that don’t excite them, speak to their values or further their mission in life. They say no to superficial networking events in which people swap business cards and never hear from one another. Why? Because successful people don’t network. They build relationships. They say no to spending time…

-

Three Best Online Stock Brokers For Beginners

As a new investor education is the most important aspect to focus on. Trying to trade stocks won’t do you any good without knowing the basics of trading stocks online. These three trading platforms for beginners offer three main things and they are simplicity, education and a strong variety of educational tools. When I first started to…

-

3 Levels of Financial Freedom

Level One- Financial Solvency Financial Solvency is when you’re able to earn enough money where your debt and living expenses equal your income. Here you are living paycheck to paycheck with no money in your savings account and no money in investment funds. You have no room for unexpected expenses or personal adventures. Just going…

-

Should Financial Literacy be taught in High School?

Yes, it should, High School fails to teach students personal finance. Instead, schools make students sit through classes forcing them to learn math that they will never use or be part of uncooperative group projects where one student does all the work. At the same time, high school tests the memorization of the material, not…

-

Dividend Reinvestment vs Compound Interest

After reviewing Dividend Reinvestments and Compound Interest I would like to make a post comparing some pros and cons. I will also give my opinion as a follow-up. Dividend Reinvestment Pros Cons Shares are appreciating assets Stock market is unpredictable More stocks = Larger dividends to reinvest Companies may not be able to pay out…

-

Compound Interest

Compound interest is the concept of investing in something like a CD (certificate of deposit) or a bond. These two both have fixed rates and a fixed sell date (called maturity date). This means the CD or Bond is worth its max on that date and you can acquire your money at that time. So…